Cleveland, Ohio – Tesla Motors’ brief consideration of going private is over, and founder and CEO Elon Musk may face legal trouble in the wake of the abandoned deal.

In early August, Musk said in Twitter that he was considering taking the electric car company private for $420 per share, about $80 more than its closing price at the time, adding that he had “funding secured.”

In the days following the announcement, Tesla shares shot up, but it quickly became apparent that the funding was tentative. Musk said Saudi Arabia’s sovereign wealth fund was the source of the funding, but following his go-private announcement, fund managers said their support was tentative, based on due diligence and internal reviews.

Several investors sued, seeking class-action status, accusing Musk of manipulating Tesla stock. The U.S. Securities and Exchange Commission reportedly has opened a probe into the actions and has subpoenaed Musk and others at Tesla to testify on plans.

Late last week, Musk said Tesla has abandoned the proposal.

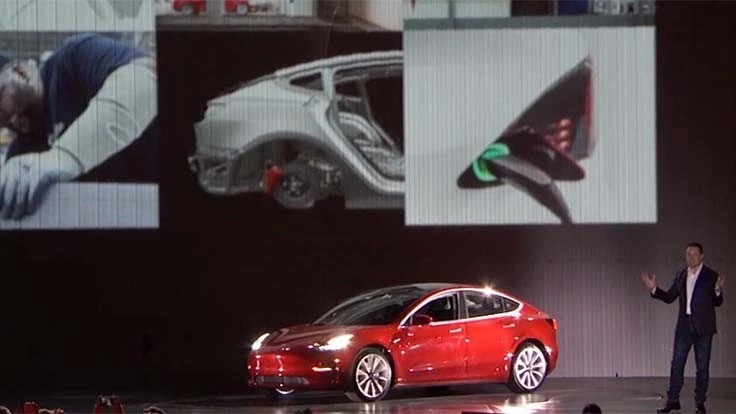

“I knew the process of going private would be challenging, but it’s clear that it would be even more time-consuming and distracting than initially anticipated,” Musk said in a blog post. “This is a problem because we absolutely must stay focused on ramping Model 3 and becoming profitable. We will not achieve our mission of advancing sustainable energy unless we are also financially sustainable.”

The Model 3 is Tesla’s lowest-priced vehicle. The company plans to eventually release versions that cost as little as $35,000, but current ones are selling for about $50,000. The vehicle had been set for high-volume production by the end of last year, but continual production delays have kept deliveries low.

In addition, the Model 3 and Tesla have been the targets of a steady drumbeat of bad news and negative speculation. Analysts have questioned the car’s build quality, investors betting against the company have speculated that production isn’t accelerating quickly enough, and news reports have shown that higher vehicle build rates led to massive amounts of repairs on finished vehicles, meaning few Model 3s are making it to customers.

Musk, in interviews and blog posts, blamed much of that negativity on short sellers – investors who make money if Tesla stock falls. Going private would have silenced that group, allowing Tesla to improve its manufacturing processes without constant scrutiny.

However, as he met with investors to discuss the plans to go private, Musk said several of them said they’d have to divest their stakes in the company.

“A number of institutional shareholders have explained that they have internal compliance issues that limit how much they can invest in a private company,” Musk said. “There is also no proven path for most retail investors to own shares if we were private.”

Tesla shares fell Monday, the first day of trading following last week’s announcement, despite a strong day for automotive and manufacturing stocks following news that the Trump Administration had reached a tentative new trade deal with Mexico.

And more investor groups filed new lawsuits against the company, again accusing it of market manipulation with Musk’s initial Tweet. In addition, regulators continue to evaluate the company’s actions for possible wrongdoing.

Complaints about Musk’s Twitter habits – the go-private Tweet and an earlier one accusing a British diver assisting cave rescue efforts in Thailand of being a pedophile – have prompted some investors to call for a new CEO or at least a strong second-in-command to reign in the founder.

In a statement sent out slightly before midnight Friday, the committee of Tesla board members who had been reviewing plans to go private said it still has confidence in the company’s leader.

“The board and the entire company remain focused on ensuring Tesla’s operational success, and we fully support Elon as he continues to lead the company moving forward,” committee members said.

Musk said ending the go-private talk will remove distractions at Tesla and allow him to focus on perfecting the Model 3 assembly process and becoming profitable, a goal that has eluded the car company for its 15-year history.

“We’ve shown that we can make great sustainable energy products, and we now need to show that we can be sustainably profitable,” Musk said.

About the author: Robert Schoenberger is the editor of Today's Motor Vehicles and a contributor to Today's Medical Developments and Aerospace Manufacturing and Design. He has written about the automotive industry for more than 18 years at The Plain Dealer in Cleveland, Ohio; The Courier-Journal in Louisville, Kentucky; and The Clarion-Ledger in Jackson, Mississippi.

Latest from EV Design & Manufacturing

- Festo Didactic to highlight advanced manufacturing training solutions at ACTE CareerTech VISION 2025

- Multilayer ceramic capacitor enters mass production

- How US electric vehicle battery manufacturers can stay nimble amid uncertainty

- Threading tools line expanded for safety critical applications

- #55 Lunch + Learn Podcast with KINEXON

- Coperion, HPB eye industrial-scale production of solid-state batteries

- Machine tool geared toward automotive structural components

- Modular electric drive concept reduces dependence on critical minerals